Pacific Panel Workshops

Takaful Malaysia Panel Workshops

Toll Free : 1 800 88 1138 (Non Life)

MSIG Panel Hospital List

What is No Claim Discount (NCD)?

The No Claim Discount (NCD) is a reward scheme received by motor policy holders for not making a claim during the preceding 12 months.

How much of No Claim Discount (NCD) am I entitled to?

Consumers are eligible for NCD ranging from 0% to 55% of the premium payable depending on the type of vehicle, coverage and number of years claim not intimated. For a private car, the scale of NCD ranges from 0% to 55% as provided in the policy/certificate whereas for motorcycles and commercial vehicles, it ranges from 0% to 25%.

Find out the current insurer for your vehicle, type of coverage, policy period and policy number by entering your details

|

|

|

|

|

ACPG Management Sdn Bhd

No matter how good your own driving skills are, owning a car can be an expensive and risky business. That’s why it pays to cover your vehicle against accident or theft.

The MSIG Motor Insurance offers you a thorough and comprehensive approach to motoring wherever you go. If your vehicle is already covered by another insurance company, switching over to MSIG is easy. You may transfer your NCD over in full.

To understand more about what you’ll be covered for with a selection from our Comprehensive Cover, Third Party, Fire & Theft Cover or Third Party Cover.

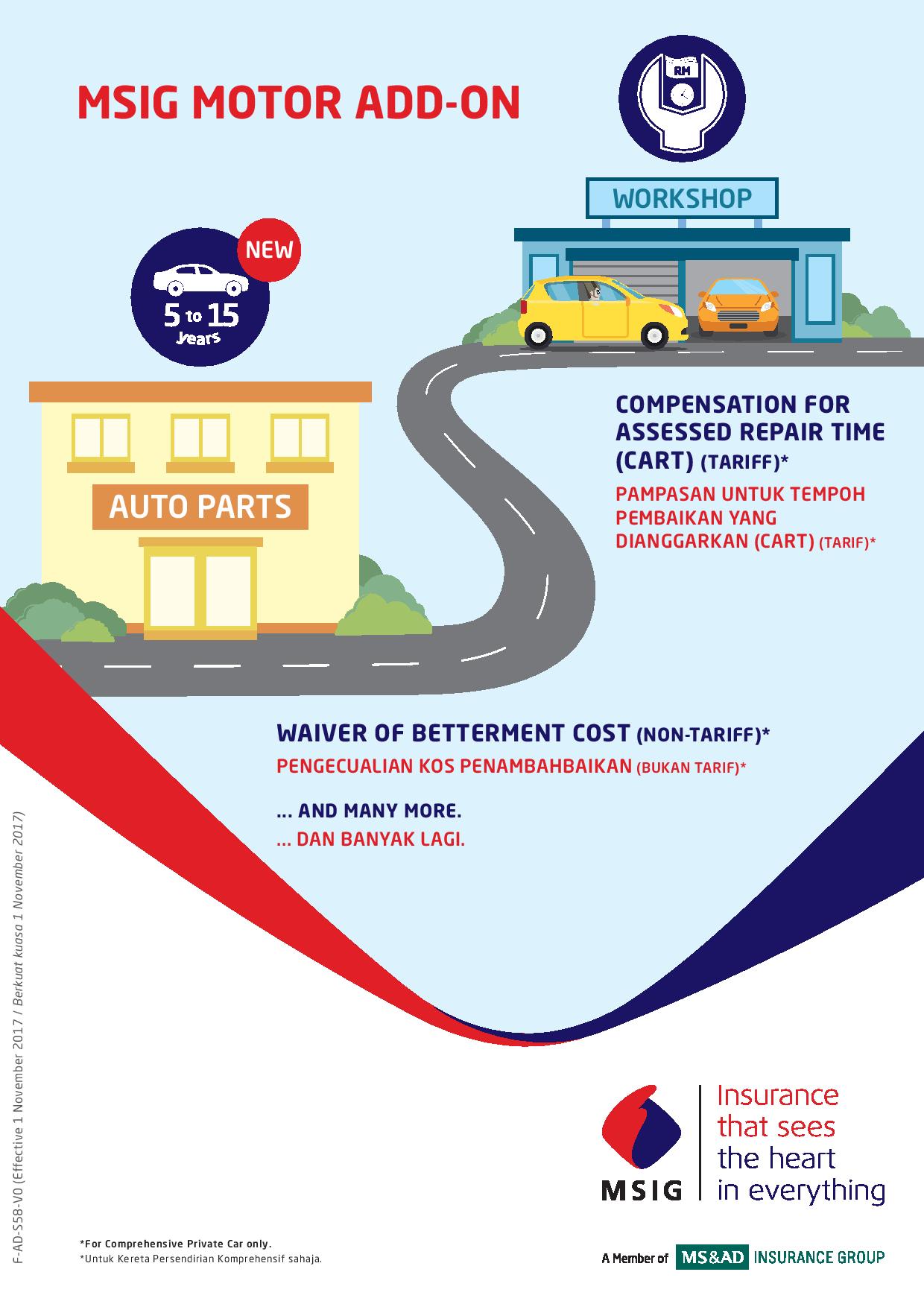

What's more, we have NEW MSIG Motor Add-On* to offer you additional benefits such as Smart Key Shield**, Special Perils - Flood, Storm, Landslide, Landslip or Subsidence Cover**, Driver's Personal Accident Insurance**, Waiver of Betterment Cost, Compensation for Assessed Repair Time (CART)**, Waiver Of Compulsory Excess* and 24-Hour Unlimited Towing Service*.

*For Comprehensive Private Car only

Why Do I Need MSIG E Hailing Motor Insurance

E-Hail E-Zee is the motor insurance add-on that all e-hailing drivers need. It supplements comprehensive protection by providing coverage when the vehicle is used for carrying e-hailing (fare-paying) passenger(s).

MSIG Motor Assist

Your policy* comes with FREE Assistance

In the unfortunate event of an accident involving your vehicle or should a breakdown occur, MSIG is at your side to help you. You are entitled to this accident/roadside service assistance without any surcharge to your policy premium.

We have a nationwide network of recommended motor repairers, ready to provide you with prompt, efficient and convenient service, whenever the need arises. Contact 1300-880-833 for assistance from MSIG Motor Assist.

*For comprehensive private car only.

Why Do I Need Extend Additional Coverage for MSIG Motor Insurance

As a car owner, it's always wise to have as much protection as possible. Especially when life may have other plans for you and your car. Situation could arise that may result in the loss or damage to your Smart Car Key, damage from flood, storm or other convulsions of nature, and even accidents involving you and your passengers.

Therefore, you should consider additional coverage to your existing Motor Insurance to help you during unexpected times.

- Smart Key Shield (Non-Tariff)*

- To cover the loss or damage of your Smart Car Key.

- Special Perils and Limited Special Perils - Flood, Storm, Landslide, Landslip or Subsidence cover (Tariff)*

- To protect your vehicle from flood and nature-related damages.

- Driver's Personal Accident Insurance (Non-Tariff)*

- To protect the driver and passengers traveling in your vehicle.

- Waiver of Betterment Cost (Non-Tariff)*

- To cover the unexpected expense of betterment costs.

- Compensation for Assessed Repair Time (CART) (Tariff)*

- To compensate for loss of use of your car based on assessed repair time by loss adjuster.

- Waiver Of Compulsory Excess (Non-Tariff)*

- To cover the unexpected expense of Compulsory Excess.

- 24-Hour Unlimited Towing Service (Non-Tariff)*

- To provide unlimited towing service that benefits those who travel on the road.

*For Comprehensive Private Car Only.

Please Click HERE for MSIG Malaysia Car Insurance Standard and Basic Coverage and Benefits (English Version)

Please Click HERE for MSIG Malaysia Car Insurance Standard and Basic Coverage and Benefits (English Version)

MSIG Motor Add-On Leaflet (Special Perils & Limited Special Perils, Smart Key Shield & Driver's PA Insurance) MSIG Motor Add-On Leaflet 1

MSIG Motor Add-On Leaflet (Waiver of Betterment Cost & Compensation for Assessed Repair Time [CART] MSIG Motor Add-On Leaflet 2

MSIG Motor Add-On Leaflet (Waiver of Compulsory Excess) MSIG Motor Add-On Leaflet 3

MSIG Motor Add-On Leaflet (24-Hour Unlimited Towing Service) MSIG Motor Add On Leaflet 4

MSIG Malaysia E Hailing Motor Insurance Policy is BACK !!!

Instant Get Quote and Renew Careline +6011-12239838 Whatsapp

Click here for your Quote

wasap.my/+601112239838/MSIGEhailingmotorinsurance

Attention Here

For Grab Drivers and All Others E Hailing Drivers........

Great News To You......MSIG Malaysia E-Hailing Motor Insurance Policy For Grab Drivers and All Others E Hailing Drivers renew their motor insurance policy with extend cover when provide e hailing service.

MSIG Malaysia First To Launch Approved E-Hailing Motor InsuranceE-Hailing Drivers Can Now Protect Themselves and Their Passengers

MSIG Insurance (Malaysia) Bhd (MSIG Malaysia) has launched E-Hail E-Zee, a new motor insurance add-on that is the first in Malaysia to provide e-hailing drivers with peace-of-mind in the event of an accident while they are providing e-hailing services.

"Many drivers assume that their standard comprehensive insurance covers them in the case of an accident when providing e-hailing services, but this is not actually the case.

Until now, drivers providing e-hailing services were at great risk of substantial financial losses if they have an accident while carrying passengers, not only from damage and injuries caused by the accident itself, but also from potential legal action by passengers if they sue the driver.

MSIG E-Hail E-Zee motor insurance add-on will provide authorised e-hailing drivers with the following cover when they are providing e-hailing services:

Loss or damage to the vehicle due to accident

Loss or damage to the vehicle due to fire or theft

Loss or damage to third-party’s vehicle or property Death or injury to third-party involved in an accident

Legal liability to passengers and legal liability of passengers Accidental Death or Permanent Disablement to the driver

The ‘Legal Liability of Passengers’ element covers unexpected negligent acts carried out by the passengers, beyond what it is reasonable for the driver to control.

This could include, for example, a passenger suddenly opening their door without checking - resulting in an accident, damages or injury to other vehicles or pedestrians.

The cost of MSIG’s E-Hail E-Zee cover will vary depending on several factors, including the vehicle’s sum insured and the policyholder’s details, as it is risk-based.

However, it will still be a relatively affordable add-on to the driver’s existing comprehensive insurance coverage.

For example, a standard vehicle that is below 1.5 CC with full 55% No-Claim-Discount (NCD) can enjoy the coverage with an additional premium ranging between RM0.30 to RM0.70 a day.

MSIG Malaysia E Hailing Motor Insurance is BACK !!!!!!!!

Shared By

Anthony Chin

CEO, ACPG

ACPG Management Sdn Bhd

Malaysia Experience Risk Management Insurance Services Provider (Since Year 1989)

Head Office

158-3-7, Blok 158, Kompleks Maluri,

Jalan Jejaka, Taman Maluri,

55100 Kualla Lumpur, Malaysia.

+603-92863323

enquiry@acpgconsultant.comwww.acpgconsultant.com

Please click HERE for ACPG Management Sdn Bhd Company Profile.

#acpginsuranceservices

#GrabCarinsurance

#Motorinsurance

#GrabCarMotorinsurance

#acpgmanagementsdnbhd

#ACPGMotorinsurance

#ACPGCarinsurance

#MSIGMotorinsurance

#MSIGEHailingMotorinsurance

#MalaysiaEHailingMotorinsurance

#MSIGMalaysiaEHailingMotorinsurance

Why Do I need MSIG Motor Insurance ?

No matter how good your own driving skills are, owning a car can be an expensive and risky business. That’s why it pays to cover your vehicle against accident or theft.

The MSIG Motor Insurance offers you a thorough and comprehensive approach to motoring wherever you go. If your vehicle is already covered by another insurance company, switching over to MSIG is easy. You may transfer your NCD over in full.

To understand more about what you’ll be covered for with a selection from our Comprehensive Cover, Third Party, Fire & Theft Cover or Third Party Cover.

What's more, we have NEW MSIG Motor Add-On* to offer you additional benefits such as Smart Key Shield**, Special Perils - Flood, Storm, Landslide, Landslip or Subsidence Cover**, Driver's Personal Accident Insurance**, Waiver of Betterment Cost, Compensation for Assessed Repair Time (CART)**, Waiver Of Compulsory Excess* and 24-Hour Unlimited Towing Service*.

*For Comprehensive Private Car only

Why Do I Need MSIG E Hailing Motor Insurance

E-Hail E-Zee is the motor insurance add-on that all e-hailing drivers need. It supplements comprehensive protection by providing coverage when the vehicle is used for carrying e-hailing (fare-paying) passenger(s).

MSIG Motor Assist

Your policy* comes with FREE Assistance

In the unfortunate event of an accident involving your vehicle or should a breakdown occur, MSIG is at your side to help you. You are entitled to this accident/roadside service assistance without any surcharge to your policy premium.

We have a nationwide network of recommended motor repairers, ready to provide you with prompt, efficient and convenient service, whenever the need arises. Contact 1300-880-833 for assistance from MSIG Motor Assist.

*For comprehensive private car only.

Why Do I Need Extend Additional Coverage for MSIG Motor Insurance

As a car owner, it's always wise to have as much protection as possible. Especially when life may have other plans for you and your car. Situation could arise that may result in the loss or damage to your Smart Car Key, damage from flood, storm or other convulsions of nature, and even accidents involving you and your passengers.

Therefore, you should consider additional coverage to your existing Motor Insurance to help you during unexpected times.

- Smart Key Shield (Non-Tariff)*

- To cover the loss or damage of your Smart Car Key.

- Special Perils and Limited Special Perils - Flood, Storm, Landslide, Landslip or Subsidence cover (Tariff)*

- To protect your vehicle from flood and nature-related damages.

- Driver's Personal Accident Insurance (Non-Tariff)*

- To protect the driver and passengers traveling in your vehicle.

- Waiver of Betterment Cost (Non-Tariff)*

- To cover the unexpected expense of betterment costs.

- Compensation for Assessed Repair Time (CART) (Tariff)*

- To compensate for loss of use of your car based on assessed repair time by loss adjuster.

- Waiver Of Compulsory Excess (Non-Tariff)*

- To cover the unexpected expense of Compulsory Excess.

- 24-Hour Unlimited Towing Service (Non-Tariff)*

- To provide unlimited towing service that benefits those who travel on the road.

*For Comprehensive Private Car Only.

MSIG Motor Add-On Leaflet (Special Perils & Limited Special Perils, Smart Key Shield& Driver's PA Insurance) MSIG Motor Add-On Leaflet 1

MSIG Motor Add-On Leaflet (Waiver of Betterment Cost & Compensation for Assessed Repair Time [CART] MSIG Motor Add-On Leaflet 2

MSIG Motor Add-On Leaflet (Waiver of Compulsory Excess) MSIG Motor Add-On Leaflet 3

MSIG Motor Add-On Leaflet (24-Hour Unlimited Towing Service) MSIG Motor Add On Leaflet 4

Frequently Asked Questions (FAQ)

If your question isn't addressed here, just contact us and we'd be glad to help!

MSIG Malaysia Motor Insurance

Is there any *Motor Assist Program offered by MSIG?

Yes, in the unfortunate event of an accident involving your vehicle or should a breakdown occur, MSIG is at your side to help you. You are entitled to this accident/roadside service assistance without any surcharge to your policy premium.

We have a nationwide network of recommended motor repairers, ready to provide you with prompt, efficient and convenient service, whenever the need arises.

24 Hour Free Assistance Number: 1-300-880-833

*Motor Assist Program is offered to Comprehensive Private Car policyholders.

What is the important point on Insured Value/Sum Insured to be considered when buying motor insurance?

If you are buying a policy against loss/damage to your vehicle, you must ensure that your vehicle is adequately insured as it will affect the amount you can claim in the event of loss /damage.

For a new vehicle, the insured value will be the purchase price while for other vehicles, the insured value is the market value of the vehicle at the point you apply for the insurance policy.

Under-insurance – If you insure your vehicle at a lower sum than its market value, you will be deemed as self-insured for the difference, i.e. in the event of loss/damage, you will only be partially compensated (up to the proportion of insurance) by your insurance company.

Over-insurance – Should you insure your vehicle at a higher sum than its market value, the maximum compensation you will receive is the market value of the vehicle as the policy owner cannot ‘profit’ from a motor insurance claim.

What are the optional add-ons which available for me to extend cover under the Comprehensive Private Car coverage through online?

We would want to recommend you to extend the following optional add-ons:

Smart Key Shield (Non-Tariff)

Windscreen

Legal Liability to Passengers

Legal Liability of Passengers

Strike, Riot and Civil Commotion

Special Perils & Limited Special Perils (Non-Tariff) (Flood, Storm, Landslide, Landslip, Subsidence Cover or Other Convulsions of Nature)

Driver's Personal Accident Cover (Non-Tariff)

Waiver of Betterment Cost (Non-Tariff)

Compensation for Assessed Repair Time (CART)

Please refer to motor add-on leaflet for details of each add-on

You may contact our distribution channel ACPG customer service at 03-92863323 for other add-ons than the above.

How do I enrol for the policy?

You may contact our distribution channel ACPG customer service at 03-92863323 for other add-ons than the above.

How do I enrol for Third Party Cover or Third Party, Fire and Theft Cover?

You may contact our distribution channel ACPG customer service at 03-92863323 for other add-ons than the above.

What are the procedures for me to cancel my policy? What if the Company decides to cancel my policy?

You may cancel the cover at any time by notifying us in writing. Within seven (7) days of the cancellation, you must surrender to us the certificate of insurance or alternatively provide us with a statutory declaration. We may also cancel this cover by giving you 14 days’ notice by registered post to your last known address. Details of the refund of premium are stated in the Policy, Cancellation Condition No. 3.

How do I make a claim?

Please provide a written notice to the Company with full details within seven (7) days upon receiving notice of or sustaining any accident, loss or damage. You may contact any MSIG Branch to obtain a copy of the claim form. Submit the completed claim form to the Company together with all relevant documents as soon as possible.

General Question and Answer

Purchase & Payment

Why is my mailing address not needed when I'm buying insurance?

It's because our entire process is done online – it's faster, easier and also paper-less! Your Certificate of Insurance/Policy will be emailed to you instead.

Can I buy this insurance online with a supplementary credit card?

Yup, you can.

Can I buy insurance from MSIG Online if I don’t own a credit card?

For right now, we’re only accepting debit and credit cards as modes of payment.

Security, Technical & Online Support

Do I need to type in my details again if I'd like to buy again in the future?

Yes, you'll need to - it's for the greater good, really! We don't keep any of your personal details in accordance to the Personal Data Protection Act 2010 and other security reasons.

Help! I made a mistake on my personal info when I was buying insurance.

Don't worry, just email us at enquiry@insuranceonlinepurchase.com.

How do I know that it's safe to buy insurance online? Will my personal info be secured?

Protecting your personal info is very important to us and there are several security features installed to ensure that your data is safe. Check out our Privacy Policy in the Terms of Use to find out more.

How do I make a claim?

You can notify us of your claim right here on MSIG Online under our "Make a Claim” section.

How do I track the status of my claim?

Once a claim has been made, you’ll receive an email acknowledgement. The email lists all the necessary documents needed to support the claim and other details.

How fast can MSIG settle my claim?

Depends on the type of claim, Turnaround for example death/theft claim will be longer than a smaller type of claim. Be assured MSIG is committed to fair and prompt settlement of claims.

If I have an enquiry on this product or any other questions, who should I refer to?

Just email us at enquiry@insuranceonlinepurchase.com with your question and we'll get you an answer!

How do I lodge a complaint if I am unhappy with the product or services?

If you have a complaint about the product or services about us, or you are not satisfied with the rejection or offer for any settlement of a claim, you should first try to resolve the complaint with our Customer Service Centre.

If you are still not satisfied with the decision, you can refer to Bank Negara Malaysia at:

Pengarah

Jabatan LINK & Pejabat Wilayah

Bank Negara Malaysia

P.O. Box 10922

50929 Kuala Lumpur.

Tel: 1-300-88-5465

Fax: 03-2174 1515

Email: bnmtelelink@bnm.gov.my

Or, you may also write to the Ombudsman for Financial Services (OFS).

Disclaimer for FAQ

The FAQs compiled herein are merely informational and not intended to be construed as a contract of insurance. While every effort has been made to ensure that the information contained herein is accurate and up to date, this is not always possible. Please refer to actual policy for exact terms and conditions of the insurance product that you are purchasing.

MSIG Car Insurance Kuala Lumpur Malaysia

MSIG Car Insurance Kuala Lumpur

MSIG Car Insurance Selangor

MSIG Car Insurance Cheras

MSIG Car Insurance Ampang

MSIG Car Insurance Kampung Pandan

MSIG Car Insurance Pandan Jaya

MSIG Car Insurance Pandan Perdana

MSIG Car Insurance Pandan Indah

MSIG Car Insurance Taman Cheras

MSIG Car Insurance Taman Pertama Cheras

MSIG Car Insurance Taman Segar Cheras

MSIG Car Insurance Taman Midah

MSIG Car Insurance Bandar Tun Razak

MSIG Car Insurance Taman Billion

MSIG Car Insurance Taman Mewah

MSIG Car Insurance Balakong

MSIG Car Insurance Bangsar

MSIG Car Insurance Pantai Dalam

MSIG Car Insurance Jalan Kelang Lama

MSIG Car Insurance Kuchai Lama

MSIG Car Insurance Sungai Besi

MSIG Car Insurance Puchong

MSIG Car Insurance Shah Alam

MSIG Car Insurance PJ

MSIG Car Insurance Petaling Jaya

MSIG Car Insurance Seri Petaling

MSIG Car Insurance Desa Petaling

MSIG Car Insurance Subang

MSIG Car Insurance USJ

MSIG Car Insurance Damansara

MSIG Car Insurance Kota Damansara

MSIG Car Insurance Kepong

MSIG Car Insurance Sungai Buluh

MSIG Car Insurance Rawang

MSIG Car Insurance Jalan Ipoh

MSIG Car Insurance Selayang

MSIG Car Insurance Gombak

MSIG Car Insurance Wangsa Maju

MSIG Car Insurance Setapak

MSIG Car Insurance Kajang

MSIG Car Insurance Sungai Long

MSIG Car Insurance Mahkota Cheras

MSIG Car Insurance Seri Kembangan

MSIG Car Insurance Kajang

MSIG Car Insurance KL

MSIG Motor Insurance Kuala Lumpur Malaysia

MSIG Motor Insurance Kuala Lumpur

MSIG Motor Insurance Selangor

MSIG Motor Insurance Cheras

MSIG Motor Insurance Ampang

MSIG Motor Insurance Kampung Pandan

MSIG Motor Insurance Pandan Jaya

MSIG Motor Insurance Pandan Perdana

MSIG Motor Insurance Pandan Indah

MSIG Motor Insurance Taman Cheras

MSIG Motor Insurance Taman Pertama Cheras

MSIG Motor Insurance Taman Segar Cheras

MSIG Motor Insurance Taman Midah

MSIG Motor Insurance Bandar Tun Razak

MSIG Motor Insurance Taman Billion

MSIG Motor Insurance Taman Mewah

MSIG Motor Insurance Balakong

MSIG Motor Insurance Bangsar

MSIG Motor Insurance Pantai Dalam

MSIG Motor Insurance Jalan Kelang Lama

MSIG Motor Insurance Kuchai Lama

MSIG Motor Insurance Sungai Besi

MSIG Motor Insurance Puchong

MSIG Motor Insurance Shah Alam

MSIG Motor Insurance PJ

MSIG Motor Insurance Petaling Jaya

MSIG Motor Insurance Seri Petaling

MSIG Motor Insurance Desa Petaling

MSIG Motor Insurance Subang

MSIG Motor Insurance USJ

MSIG Motor Insurance Damansara

MSIG Motor Insurance Kota Damansara

MSIG Motor Insurance Kepong

MSIG Motor Insurance Sungai Buluh

MSIG Motor Insurance Rawang

MSIG Motor Insurance Jalan Ipoh

MSIG Motor Insurance Selayang

MSIG Motor Insurance Gombak

MSIG Motor Insurance Wangsa Maju

MSIG Motor Insurance Setapak

MSIG Motor Insurance Kajang

MSIG Motor Insurance Sungai Long

MSIG Motor Insurance Mahkota Cheras

MSIG Motor Insurance Seri Kembangan

MSIG Motor Insurance Kajang

About MSIG

MSIG Malaysia is one of the largest general insurers in the nation! We have a network of 20 branches in various locations across Malaysia, ensuring that we're close by whenever you need us.

A subsidiary of Mitsui Sumitomo Insurance Company, Limited and a member of MS&AD Insurance Group Holdings, Inc., MSIG Insurance (Malaysia) Bhd has a strong financial backing combined with global expertise and local knowledge. Our multi-channel distribution network has established strong partnerships with agents, brokers or motor franchises, local and Japanese direct corporate clients, as well as partnership programmes with financial institutions.

As a customer, you can expect financial stability, top quality innovative insurance products and related services, and a strong commitment to service. We aim to serve our customers, stakeholders and society by adhering to our Values:

Customer Focused

We continuously strive to provide security and achieve customer satisfaction.

Integrity

We are sincere, kind, fair and just in our dealings with everyone.

Teamwork

We achieve mutual growth by respecting one another's individuality and opinions, and by sharing knowledge and ideas.

Innovation

We listen to our stakeholders and continuously seek ways to improve our work and business.

Professionalism

We make sustained efforts to improve our skills and proficiency so that we can provide high quality services.

About ACPG Management Sdn Bhd

We ACP Group (ACPG) had more than 30 years (since year 1989) insurance experience. These solid years of experience has earned us a reputation of providing "TOTAL INSURANCE SOLUTION" and to be the most Organized and Respectable Insurance Intermediary in this region and all our journey to excellent, we aspire to set legend in the Malaysia insurance industry.

Based on ACPG have more than 30 years hard experience in the industry, we have the capability to handle the insurance needs of our clients professionally effectively and economically.

ACPG is organized to maximize the potential of its employees and to continuously deliver professional service to its clientele. ACPG management philosophy is to provide the necessary training and development courses to its employees to ensure that they are abreast of developments in risk management, insurance coverage and claims procedures.

The goals of ACPG are to: deliver value-added professional service to all its customers; create comprehensive and quality insurance products and services with competitive terms; uphold its reputation for integrity and innovation; enhance the professional and personal growth of its employees to empower them to do their personal best; and maintain a profitable business for the benefit of its insured’s, principals, employees and clients.

For more details, please visit http://www.acpgconsultant.com/.

ACP Group of Companies

www.acpgconsultant.com

03-92863323

011-12239838

012-6489838

|

|

|

|

|

|

|

|

|

|